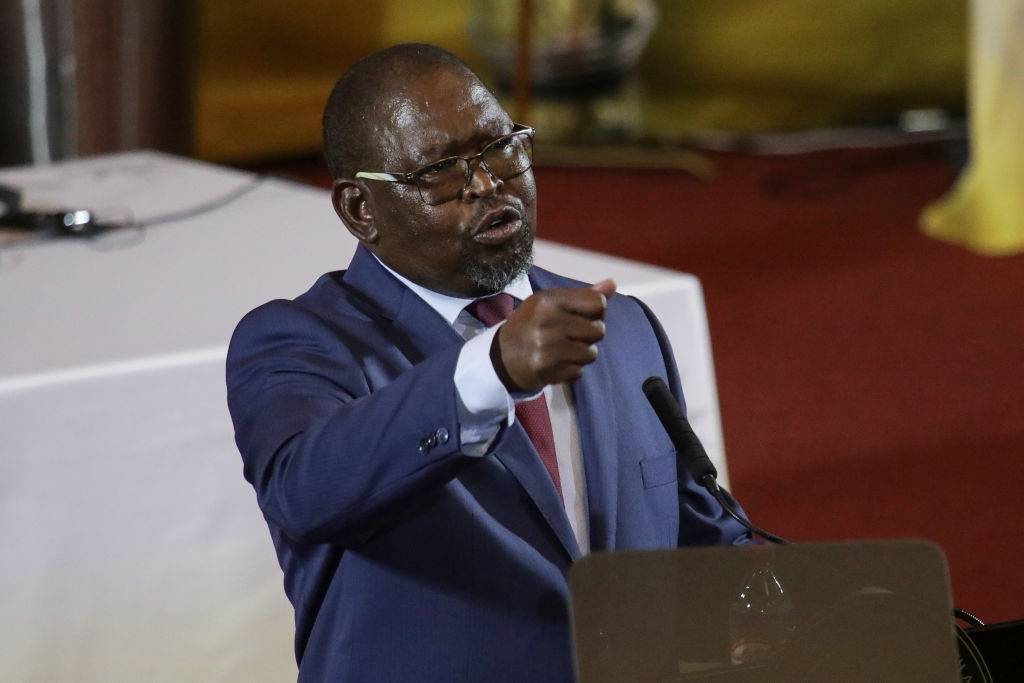

As Finance Minister Enoch Godongwana prepares to deliver his highly anticipated Budget Speech on Wednesday, South Africans are being urged to take a hard look at their finances. With household debt levels soaring and economic uncertainty looming, experts warn that proactive steps are needed to avoid further financial strain.

The Budget Speech Context

The Budget Speech, originally scheduled two weeks ago, was postponed after members of the Government of National Unity (GNU) rejected Godongwana’s proposed 2% increase in Value Added Tax (VAT). The proposed hike faced widespread criticism, with opposition parties and advocacy groups arguing that it would place an additional burden on already struggling households.

Jacob Zuma’s MK Party has even threatened nationwide protests if the VAT increase proceeds. Meanwhile, advocacy group Black Sash has accused the minister of using the Social Relief of Distress (SRD) grant as leverage to push for the VAT hike. Godongwana has stated that reducing SRD grants could eliminate the need for a VAT increase, but this has done little to quell public concern.

The government, grappling with funding for essential services like education and healthcare, had hoped the VAT increase would alleviate financial pressures. However, with household debt reaching 40.7% of the country’s nominal GDP by the end of September 2024, many South Africans are feeling the pinch.

Expert Advice: Tackling Debt Head-On

Salem Nyati, a Consumer Financial Education Specialist at Momentum Group, emphasizes the importance of revisiting personal finances ahead of the Budget Speech. “Much like the government is reviewing its budget, South Africans should be doing the same. It’s important to ensure your spending aligns with your financial goals, especially as the cost of living continues to rise,” she said.

Nyati offers the following tips to help consumers manage their debt effectively:

- Prioritize High-Interest Debt: Focus on paying off high-interest debt first, particularly credit card balances, which can quickly spiral out of control.

- Explore Debt Consolidation: Consider consolidating or refinancing debt to make repayments more manageable and reduce interest costs.

- Build an Emergency Fund: Set aside money for unexpected expenses to avoid falling deeper into debt during emergencies.

- Align Spending with Long-Term Goals: Just as the government prioritizes essential services, individuals should focus on necessities while planning for the future—whether that means paying down debt, saving, or investing.

The Bigger Picture

Nyati encourages South Africans to take control of their financial well-being, regardless of external economic changes. “As we await the National Budget, people shouldn’t wait for external changes to improve their financial situation. Taking action today can make a real difference,” she concluded.

With the Budget Speech expected to address critical issues like VAT, SRD grants, and government spending, South Africans must remain vigilant about their financial health. By addressing debt and adopting smarter financial habits, households can better navigate the challenges ahead.

Follow Joburg ETC on Facebook, Twitter , TikTok and Instagram

For more News in Johannesburg, visit joburgetc.com